Introduction To PRSF Scheme

PROJECT OBJECTIVE

The International Bank for Reconstruction and Development ("World Bank"), as implementing agency of each of the Global Environment Facility("GEF") and the Clean Technology Fund ("CTF"), has provided support for a project titled "Partial Risk Sharing Facility for Energy Efficiency" ("PRSF"/Programme").

The key objective of the Partial Risk Sharing Facility for Energy Efficiency (PRSF) Project is to assist India in achieving energy savings with mobilization of commercial finance and participation of energy service companies.The Programme is to support the Government of India’s efforts to transform energy efficiency market in India by promoting increased level of investments in energy efficient projects, particularly through energy service performance contracting delivered through energy service companies ("ESCOs"). The Programme will support the loans granted by various PFIs and by SIDBI as lender (in such capacity, “SIDBI as Lender”), who are empanelled with the PEA Division to either ESCOs or the Host who are implementing energy saving projects, by providing risk coverage for repayment of such loans.

Partial Risk Sharing Facility for Energy Efficiency (PRSF) Project - India

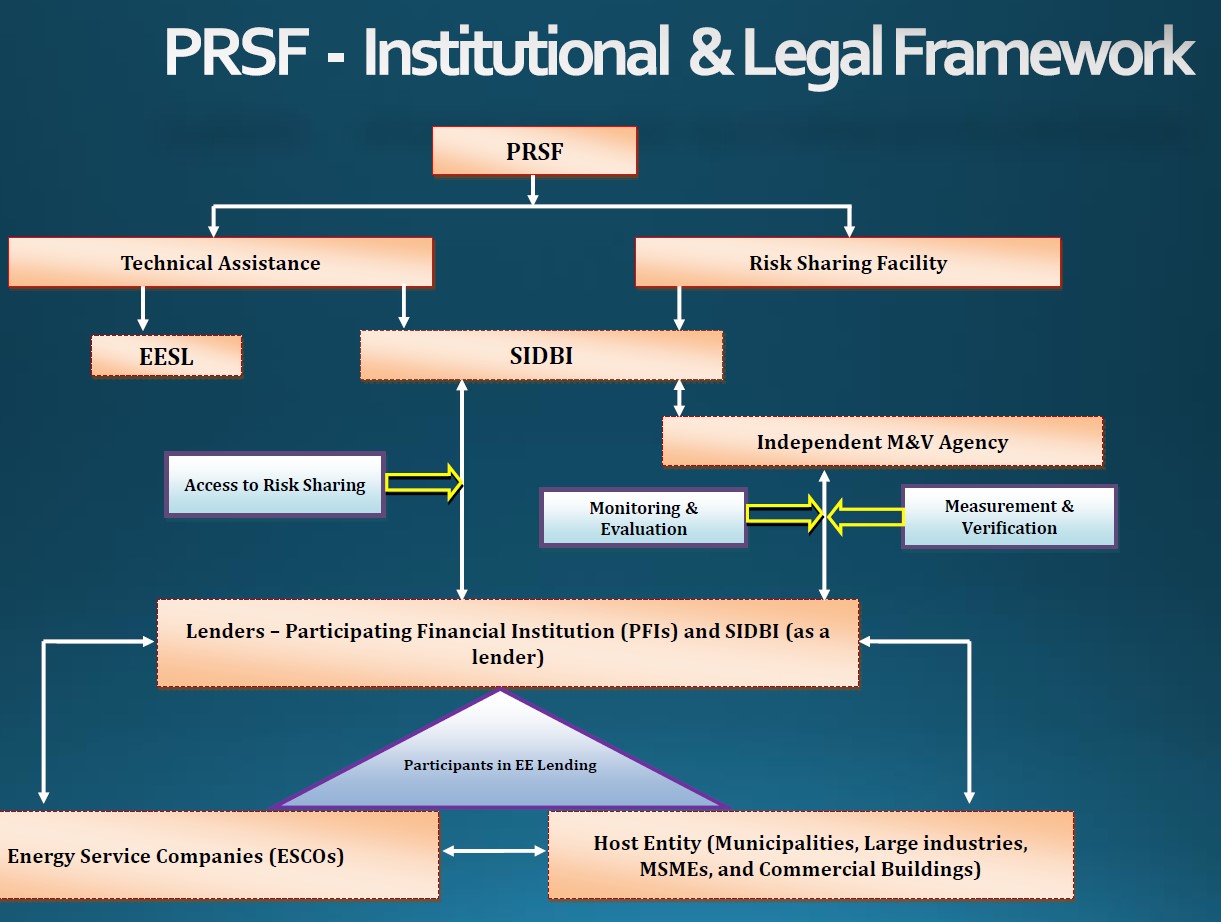

The objective of the Partial Risk Sharing Facility for Energy Efficiency (PRSF) Project is to assist India in achieving energy savings with mobilization of commercial finance and participation of energy service companies. This project consists of two components. The first component supports establishing and operating the Facility to provide Sub-Guarantees to Sub-Financiers and developing energy efficiency markets through end-to-end solutions and measurement and verification (M&V) activities.

The partial risk sharing facility for energy efficiency is managed by Small Industries Development Bank of India (SIDBI), funded from a Global Environment Facility (GEF) contribution and backstopped by a Clean Technology Fund (CTF) Guarantee, in the form of contingent finance. Component two supports technical assistance, capacity building, and operations support comprising, among other things, the following activities: i. Carrying out market development, Project management, awareness building, and outreach to beneficiaries and stakeholders. ii. Undertaking legal due diligence and dispute resolution involving Sub-Projects. iii. Developing and maintaining the Facilitys website and online presence; a management information system; and other reporting systems. iv. Developing standard appraisal and transaction documents, reporting templates, energy efficient guidelines, strengthening Project report generation, capacity building and training, and online support. v. Providing technical assistance and capacity building for Participating Financial Institutions, Energy Service Companies, and Beneficiaries.

The Partial Risk Sharing Facility will be available for supporting EE loans made by SIDBI and by participating financial institutions (PFIs) that will be empanelled and sign an Agreement with the PEA as part of this project. A guarantee fee, at a pre-determined rate, will be charged for each EE sub-project supported under PRSF. While the guarantee window for SIDBI loans, to be maintained as a sub-account, will have an initial corpus of US$6 million of GEF grant for risk coverage, the window for guarantee calls from PFIs (excluding SIDBI), in the second sub-account, will also have an initial corpus of US$6 million GEF grant for risk coverage and will in addition be backstopped by additional risk coverage through CTF guarantee of US$25 million (contingent finance).

To be eligible for credit guarantees from PRSF, PFI loans will have to be for EE projects that are implemented by ESCOs. For projects to be eligible, the implementing ESCO will have to have an energy savings performance contract (ESPC) with the beneficiary host entity. Further, PFIs will submit the information in the standard templates as specified from time to time.

Project Components

The PRSF project will consist of a risk sharing facility for energy efficiency, managed by SIDBI, of US$37 million, funded from a Global Environmental Facility (GEF) contribution of US$12 million and backstopped by a Clean Technology Fund (CTF) Guarantee, in the form of contingent finance, of US$25 million, and a technical assistance component.

How PRSF Works

Client

Saving Based on performance

Energy Services, M&V of savings

ESCO

Debt Payment

loan PRSF (Guarantee Coverage)

Financial Institutions

Financial Institutions :SIDBI, YES Bank, Corporation Bank, Tata Cleantech, Electronical Finance.

This project consists of two components.The Project has a total outlay of USD 43 million consisting of the “Partial Risk Sharing Facility for Energy Efficiency” component of USD 37 million and technical assistance component of USD 6 million.

Legal Framework

The entire “Risk Sharing Facility” component of USD 37 million is managed by SIDBI,under which partial credit guarantees are provided to cover a share of default risk faced by Participating Financial Institutions (PFI) in extending loans to eligible EE projects implemented through ESCOs.The first component supports establishing and operating the Facility to provide Sub-Guarantees to Sub-Financiers and developing energy efficiency markets through end-to-end solutions and measurement and verification (M&V) activities. The partial risk sharing facility for energy efficiency is managed by Small Industries Development Bank of India (SIDBI), funded from a Global Environment Facility (GEF) contribution and backstopped by a Clean Technology Fund (CTF) Guarantee, in the form of contingent finance.

The technical assistance component of USD 6 million are managed by SIDBI and EESL,under which capacity building activities and other developmental/operational support for the project are provided. Under the Programme, scheduled commercial banks and non-banking financial companies (NBFCs), registered with Reserve Bank of India ("RBI") would be eligible to express their interest for empanelment with the PEA Division for the Programme to participate as participating financial institutions ("PFIs"). Component two supports technical assistance, capacity building, and operations support comprising, among other things, the following activities:

1.

Carrying out market development, Project management, awareness building, and outreach to beneficiaries and stakeholders.

2.

Undertaking legal due diligence and dispute resolution involving Sub-Projects.

3.

Developing and maintaining the Facility’s website and online presence; a management information system; and other reporting systems.

4.

Developing standard appraisal and transaction documents, reporting templates, energy efficient guidelines, strengthening Project report generation, capacity building and training, and online support.

5.

Providing technical assistance and capacity building for Participating Financial Institutions, Energy Service Companies, and Beneficiaries.

6.

The above two components are designed to strengthen the market-driven energy efficiency ecosystem conditions necessary for addressing EE market barriers and development objectives identified in Section II. Both SIDBI and Energy Efficiency Services Limited (EESL) are leading institutions in India in the area of energy efficiency (EE) financing and EE and energy service companies (ESCO) market development

Notice & Circulars

Empowering Dreams

Partial Risk Sharing Facility for Energy Efficiency

29/09/2023

Empowering Dreams

Partial Risk Sharing Facility for Energy Efficiency

29/09/2023

Empowering Dreams

Partial Risk Sharing Facility for Energy Efficiency

29/09/2023

Frequently Asked Questions

PRSF is designed to benefit a wide range of stakeholders, including businesses, homeowners, and organizations seeking support for energy efficiency projects.

PRSF supports a diverse array of energy efficiency projects, such as retrofitting buildings, upgrading lighting systems, and implementing renewable energy solutions.

Financial institutions play a pivotal role in PRSF by providing funding and expertise to help facilitate energy efficiency projects, making them more accessible.

PRSF aims to be inclusive and typically is not limited to specific regions or sectors, fostering energy efficiency projects in diverse areas and industries.

Yes, governments and public entities are encouraged to participate in PRSF, as their involvement can drive significant impact in promoting energy efficiency on a broader scale.

Stay in the know with our newsletter! Subscribe for updates.